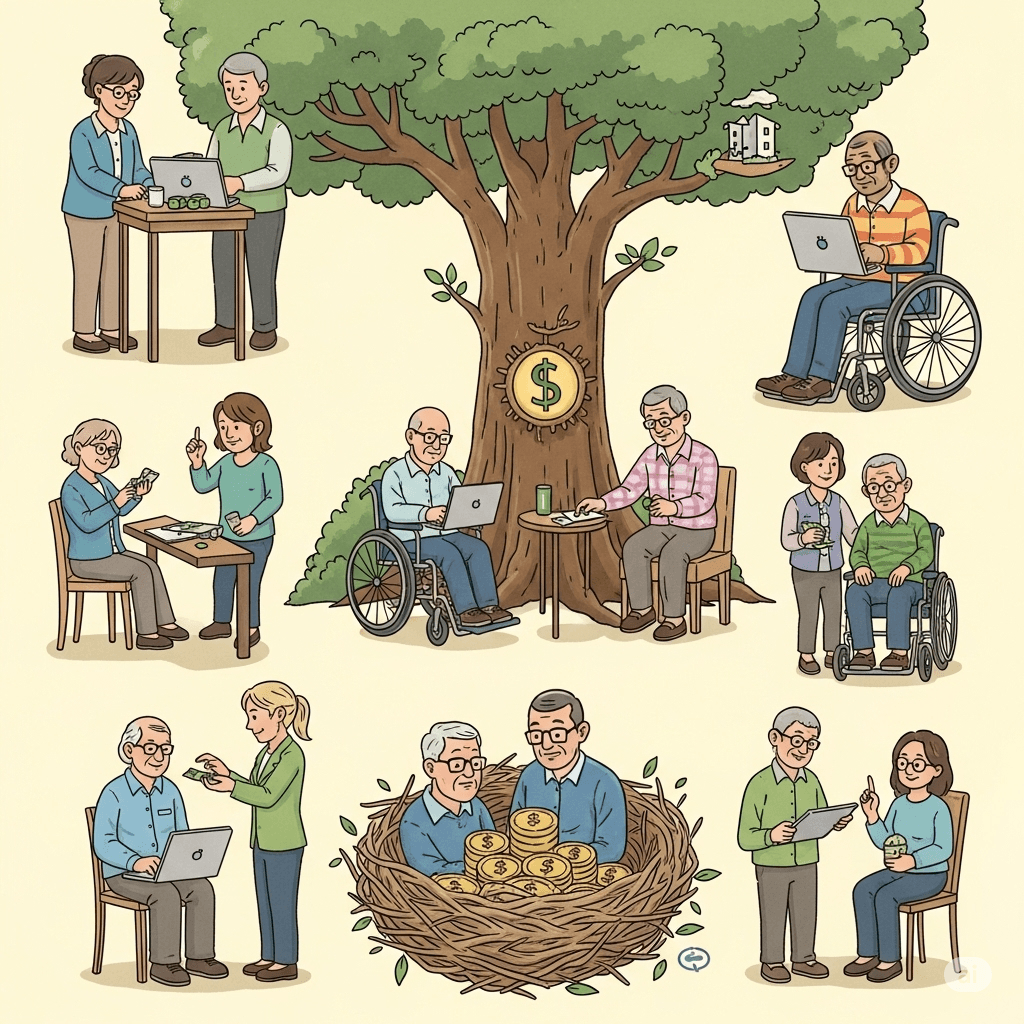

Planning for the long-term financial security of a child or adult with Cerebral Palsy (CP) often involves navigating complex legal and financial landscapes. One of the most powerful tools available is the Special Needs Trust (SNT). An SNT allows assets to be held for the benefit of an individual with disabilities without jeopardizing their eligibility for crucial government benefits like Medicaid and Supplemental Security Income (SSI). Understanding the different types of SNTs and their benefits is essential for ensuring a secure financial future.

Why a Special Needs Trust is Crucial

Government benefits like Medicaid and SSI have strict income and asset limitations. Without careful planning, an inheritance, gift, or settlement could disqualify an individual with CP from receiving these vital supports. A Special Needs Trust provides a legal framework to hold and manage assets for their benefit while preserving their eligibility for public assistance. This ensures they can access necessary medical care, housing, and other essential services without depleting their own resources.

Types of Special Needs Trusts

There are primarily two main types of Special Needs Trusts:

- Third-Party Special Needs Trust (Supplemental Needs Trust): This type of trust is established and funded by a third party, such as parents, grandparents, or other family members, using their own assets. The assets in this trust are never considered to be owned by the beneficiary with CP for the purposes of government benefit eligibility. Upon the death of the beneficiary, any remaining funds in the trust can be distributed to other designated beneficiaries.

- First-Party Special Needs Trust (d4A Trust, Payback Trust): This type of trust is established with the beneficiary’s own assets, typically funds received from a personal injury settlement or inheritance. It is subject to specific regulations, including a “payback” provision. This means that upon the death of the beneficiary, any remaining funds in the trust must first be used to reimburse the state for any Medicaid benefits received during the beneficiary’s lifetime. Strict rules and age limitations (generally must be established before age 65) apply to first-party SNTs.

Key Benefits of a Special Needs Trust

Establishing a Special Needs Trust offers numerous advantages:

- Preservation of Government Benefits: The primary benefit is protecting eligibility for Medicaid and SSI, ensuring access to essential healthcare and income support.

- Supplementing Basic Needs: Trust funds can be used to pay for a wide range of supplemental needs beyond what government benefits cover, such as therapies, specialized equipment, recreation, travel, and personal care items.

- Ensuring Long-Term Security: An SNT provides a mechanism to ensure financial resources are available to support the individual with CP throughout their lifetime, even after the passing of family caregivers.

- Professional Management: A trustee, who can be a family member, friend, or professional trustee, is responsible for managing the trust assets prudently and in the best interest of the beneficiary.

- Peace of Mind for Caregivers: Knowing that a financial plan is in place for their child’s future provides significant peace of mind for parents and other caregivers.

Establishing a Special Needs Trust: The Importance of Legal Expertise

Creating a Special Needs Trust is a complex legal process that requires a thorough understanding of federal and state regulations. It is **essential to consult with an experienced attorney specializing in estate planning and special needs law** to establish a trust that meets your specific needs and complies with all applicable rules. A knowledgeable attorney can guide you through the following crucial steps:

- Determining the appropriate type of SNT.

- Drafting the trust document with the necessary legal language.

- Naming a suitable trustee and successor trustees.

- Understanding the responsibilities of the trustee.

- Properly funding the trust.

- Ensuring compliance with ongoing trust administration requirements.

Finding Legal Assistance: How CP Family Help Can Be a Resource

While CP Family Help is not a law firm and does not provide direct legal services, it serves as a **valuable informational resource** for families navigating the complexities of Cerebral Palsy. The website can help you:

- Understand the general concepts of Special Needs Trusts and their importance.

- Learn about the different types of SNTs and their basic requirements.

- Find information and links to organizations that may offer referrals to qualified special needs attorneys in your area.

- Connect with other families who have experience establishing and managing SNTs, offering peer support and insights.

- Access information about financial planning resources and government benefit programs relevant to individuals with CP.

By providing a foundational understanding of SNTs and directing you towards relevant resources, CP Family Help empowers you to take informed steps in securing your child’s long-term financial well-being by seeking qualified legal counsel.

Conclusion: Securing a Brighter Future Through Careful Planning

A Special Needs Trust is a powerful tool for ensuring the long-term financial security of individuals with Cerebral Palsy while protecting their access to essential government benefits. While establishing an SNT requires the expertise of a qualified attorney, resources like CP Family Help can provide valuable information and support as you navigate this crucial aspect of future planning. Taking proactive steps today can provide peace of mind and ensure a more secure and fulfilling future for your loved one with CP.

Frequently Asked Questions (FAQ)

Who can be the trustee of a Special Needs Trust?

The trustee can be a responsible adult, such as a family member or friend, or a professional trustee (e.g., a bank trust department or a non-profit organization with expertise in trust administration).

What types of expenses can a Special Needs Trust pay for?

An SNT can pay for a wide range of supplemental needs, including medical and dental care not covered by insurance, therapies, specialized equipment, education, recreation, travel, and personal care assistance.

Can I fund a Special Needs Trust with an inheritance?

Yes, an inheritance can be used to fund either a third-party or a first-party Special Needs Trust, depending on who the inheritance is intended for.

What is the “payback” provision in a first-party Special Needs Trust?

The payback provision requires that upon the death of the beneficiary, any remaining funds in the first-party SNT must first be used to reimburse the state for Medicaid benefits received during the beneficiary’s lifetime.

How often should a Special Needs Trust be reviewed?

It’s advisable to review the SNT periodically, especially after significant life events or changes in laws, to ensure it continues to meet the beneficiary’s needs and comply with regulations.

Where can I find a qualified attorney to help me establish a Special Needs Trust?

You can seek referrals from organizations serving individuals with disabilities, your state’s bar association, or online directories of estate planning and special needs attorneys. Resources on websites like CP Family Help may also provide links to relevant organizations.

What is the difference between a Special Needs Trust and a guardianship?

A Special Needs Trust manages financial assets, while guardianship is a legal arrangement that grants an individual the authority to make personal and medical decisions for another person deemed incapable of doing so themselves. They serve different but potentially complementary purposes.

👉 Fill out our FREE Consultation Form today to speak with a legal expert. Your case could make a difference.

Cerebral Palsy Long Term Care Lawyer: 5 Funding Lifelong Needs

[…] was caused by preventable medical negligence, and you’re seeking to secure comprehensive long-term care and financial stability for their future, don’t hesitate. For experienced and compassionate […]